property taxes

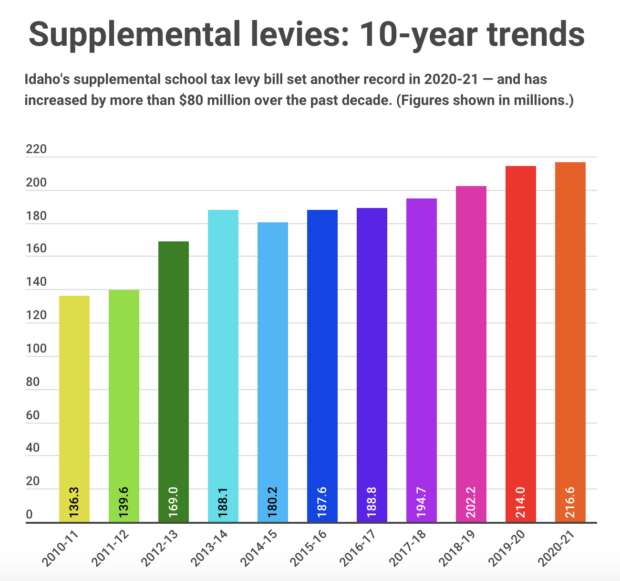

Idaho’s supplemental levy bill sets another record

All told, 92 districts will collect $216.6 million in voter-approved property taxes — the fifth successive year of record supplemental levies.

For the first time, Idaho’s supplemental school levy bill tops $200 million

Across Idaho, 93 of Idaho’s 115 school districts continue to rely on extra help from local taxpayers.

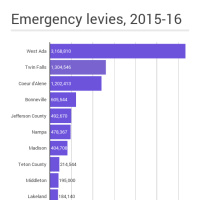

Districts impose $9.2 million in emergency levies

Growing school districts can impose the levies without getting voter approval. And in one district, trustees bypassed a vote on a $1.8 million levy.

At $194.7 million, Idaho’s supplemental levy bill keeps rising

During the recession, schools used the local levies to offset unprecedented state budget cuts. The state’s K-12 budget is rebounding, but districts are still relying on help from local taxpayers.

Analysis: A taboo topic for the funding formula committee

Lawmakers are starting to talk about how to carve up dollars for K-12. But they have no interest in talking about whether Idaho should shift more school funding back to the property tax.

Growing districts collect $7.7 million in emergency levies

The emergency levies provide money for districts to meet the demands of growth. They can be passed without voter approval.

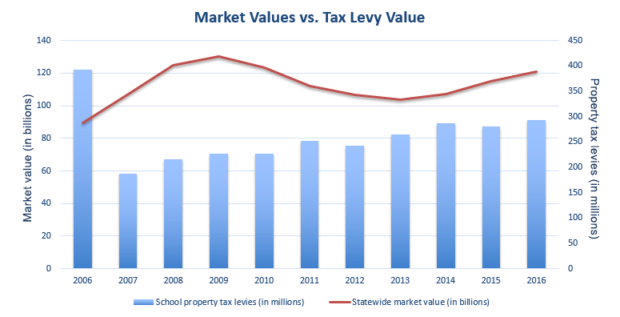

Tax shift of 2006 adds up to tax increase

A decade ago, lawmakers and then-Gov. Jim Risch promised Idahoans tax relief. Instead, Idahoans paid an additional $21.7 million to support K-12 in 2015-16, according to an Idaho Education News analysis.

What the 2006 overhaul did to taxes in your school district

Do you want to see what happened with property taxes and market values in your district? Start here.

Taking a deep dive into the 2006 tax shift

In August 2006, Idaho lawmakers slashed $260 million in public school property taxes. How did the move affect K-12? How did it affect taxpayers? We take an in-depth look.

Two districts collect emergency levies — despite enrollment decreases

The levies, designed to offset growth, are based not on enrollment, but on daily school attendance. And it’s up to districts to do their own math.