In August 2006, then-Gov. Jim Risch promised Idahoans $260 million in property tax relief.

He did deliver a tax cut to property owners.

But he did not deliver Idahoans an overall tax cut, according to an in-depth Idaho Education News analysis.

Instead, in 2015-16, Idahoans paid an additional $21.7 million for K-12 than they would have paid under the old tax structure — mostly because they now pay a higher sales tax.

Instead, in 2015-16, Idahoans paid an additional $21.7 million for K-12 than they would have paid under the old tax structure — mostly because they now pay a higher sales tax.

By the same token, that also means schools are collecting more tax dollars than they would have received under the pre-2006 tax structure. But there are winners and losers. The losers: 18 of Idaho’s 115 school districts are collecting fewer state and local dollars than they did a decade ago, when the Risch tax shift went into law. The winners: 26 districts are collecting more local property tax dollars than they did a decade ago.

The tax overhaul, explained

Idaho’s school finance formula is notoriously complicated. But Risch’s House Bill 1 — passed in a rare, one-day special legislative session on Aug. 25, 2006 — was fairly simple.

In order to understand what has happened over the past 10 years, let’s walk through the way this law was put together:

- First, House Bill 1 eliminated Idaho’s “maintenance and operations” property tax levy for schools — better known as the “M&O levy.” This levy came to roughly $300 for every $100,000 of residential, business or agricultural property. Projected tax savings: $260 million.

- Second, House Bill 1 added a sixth cent onto Idaho’s sales tax rate. Projected impact: $210 million.

- Third, House Bill 1 set aside $100 million into a new state rainy-day account, dedicated only to K-12 — the Public Education Stabilization Fund.

Risch and his legislative allies said House Bill 1 would provide $50 million in net tax relief. And in the midst of a housing and commercial boom, they said it would provide some much-needed relief from skyrocketing property taxes — and possibly even head off a property tax revolt.

Ten years later: a math problem

So, what really happened? Let’s crunch the numbers, based on State Department of Education and the Division of Financial Management:

The maintenance and operations levy. As promised, drastically cutting the M&O levy provided $260 million in property tax relief in 2006-07. And because statewide property values have grown by 13.1 percent since 2006-07, the value of the property tax break has increased as well. In 2015-16, the tax break carried a value of $303.1 million.

The increase in supplemental levies. The past decade has seen a proliferation in supplemental school levies — voter-approved taxes that run one or two years. When lawmakers approved House Bill 1, 59 of Idaho’s districts had supplemental levies on the books, for a total of $79 million. By 2015-16, 94 districts had supplemental levies worth $186.6 million. This increase comes to $107.6 million.

The sales tax. In 2015-16, Idahoans paid slightly more than $1.3 billion in sales taxes. One-sixth of that total — reflecting the sixth cent of sales tax passed in August 2006 — translates to $217.2 million.

In other words, Idahoans paid out $324.8 million in supplemental property tax levies and added sales taxes in 2015-16, while reaping property tax relief worth $303.1 million. The net effect: a tax increase of $21.7 million.

The supplemental levy shuffle

There is no debating the fact that, in the past decade, the supplemental levy has become almost commonplace in Idaho schools. More than 80 percent of Idaho’s school districts collect a voter-approved levy.

Instead, the debate centers on cause and effect. Did the tax overhaul — and the unprecedented state budget cuts from the Great Recession — force cash-starved school districts to plead their case to local voters? Or did House Bill 1’s property tax relief actually make it easier for school districts to secure voter support for levies and bond issues?

A decade later, that debate continues.

Like nearly every Democrat in the Legislature in August 2006, Rep. John Rusche of Lewiston voted against House Bill 1. Democrats said the shift would move school funding from a stable property tax levy to a volatile statewide sales tax — and leave districts scrambling to fill their budgets at the first sign of economic malaise.

“We set ourselves up to fail with education,” said Rusche, now the House’s minority leader.

In August 2006, Emmett Republican Brad Little was one of 24 Republican state senators who helped pass House Bill 1. The lieutenant governor and gubernatorial candidate says the overhaul was an imperfect attempt to address growing public unrest over an already unpopular property tax.

“The little button on the top of the pressure cooker was up,” Little said.

Little and Risch say they were not surprised by the increase in supplemental levies. And in a recent interview, Risch said the supplemental levies offer a distinct advantage. They allow patrons to have a say over how much they are willing to pay for local schools.

“It just boggles my mind that people are afraid to let people vote on these things,” said Risch, now in his second term in the U.S. Senate.

Winners and losers

The old M&O levy had a built-in equalization mechanism. The state would send more general fund dollars to poorer school districts that had a smaller property tax base.

But when it comes to the supplemental levy, districts are on their own. They collect and retain what they can pass locally. Districts that cannot pass a levy are almost wholly dependent on state funding.

The result: The bottom line varies widely from district to district.

- Twenty-six of Idaho’s 115 districts collect more property tax dollars than they collected in 2005-06, under the old M&O levy. This list includes Blaine County and McCall-Donnelly, two tourist communities that were granted special taxing authority under the 2006 law. Most of the others are rural districts, where administrators have convinced voters to pass supplemental levies that exceeded the M&O levies that were in place a decade before. In other words, these districts benefit both from the local supplemental levy and from their share of an increased sum of state dollars.

- However, 18 districts received fewer state and local dollars in 2015-16 than they did in 2005-06, the year before the tax overall went into effect. Almost all of these districts are small and rural. Seventeen of these districts have seen their student numbers drop since 2005-06. Eleven of these districts collected a supplemental levy in 2015-16, but seven did not. Thirteen of these districts have adopted a four-day school calendar — a move often driven by budgetary constraints.

In researching this series, Idaho Education News compiled a number of key findings on school taxes and budget impacts, and emailed them to key decisionmakers — including Risch. During an Aug. 6 interview, Risch said he had not reviewed the findings, emailed to his staff on July 21, and said he had no insight into the funding gaps.

“I’m not familiar with those numbers,” he said.

Other sitting lawmakers are more familiar with the funding gaps, but they view it differently.

The funding gaps can best be explained by student attendance, said Rep. Wendy Horman, R-Idaho Falls, a former school trustee who is a key member of the budget-writing Joint Finance-Appropriations Committee.

Average student attendance is still the main yardstick used to carve up Idaho’s K-12 dollars. When a district grows from one year to the next, it will qualify for a funding increase. But when student attendance drops, state funding drops accordingly. The 18 districts that lost funding over the past decade would have lost funding, with or without the 2006 tax shift, said Horman. That’s because almost all of the districts had a decline in student numbers.

But to Rusche, the gaps underscore a bigger question about whether Idaho is meeting its constitutional mandate to provide a common and uniform public school system. His hometown district in Lewiston is better-equipped to handle a downturn than Kamiah, a nearby rural district that has struggled with declining enrollment and shrinking budgets.

Ultimately, he says, Kamiah students do not live in a vacuum.

“The kids in Kamiah are the ones who seek jobs in Lewiston,” he said.

A decade of instability

By any measure, the decade since August 2006 has been a turbulent one for Idaho school administrators.

The Great Recession came only a couple of years after the passage of House Bill 1. Declining sales and income tax revenues forced the Legislature to impose unprecedented cuts on the public school system.

Driven by global economic forces, the recession surely would have wreaked havoc on the state’s budget, with or without House Bill 1. And even critics say House Bill 1 provided a valuable buffer, creating a $100 million education reserve that helped stave off even deeper budget cuts.

Still, the critics say the tax shift left schools at the mercy of the global economy. The schools were weaned off a reliable property tax levy and forced to depend on an unstable sales tax. And when sales tax collections crashed — taking school budgets down with them — school administrators were forced to go to voters seeking stopgap supplemental levies.

And for districts that could not secure a supplemental levy, the picture became even more grim, said Rob Winslow, executive director of the Idaho Association of School Administrators.

“You’ve had to do some pretty drastic things to hang on,” he said.

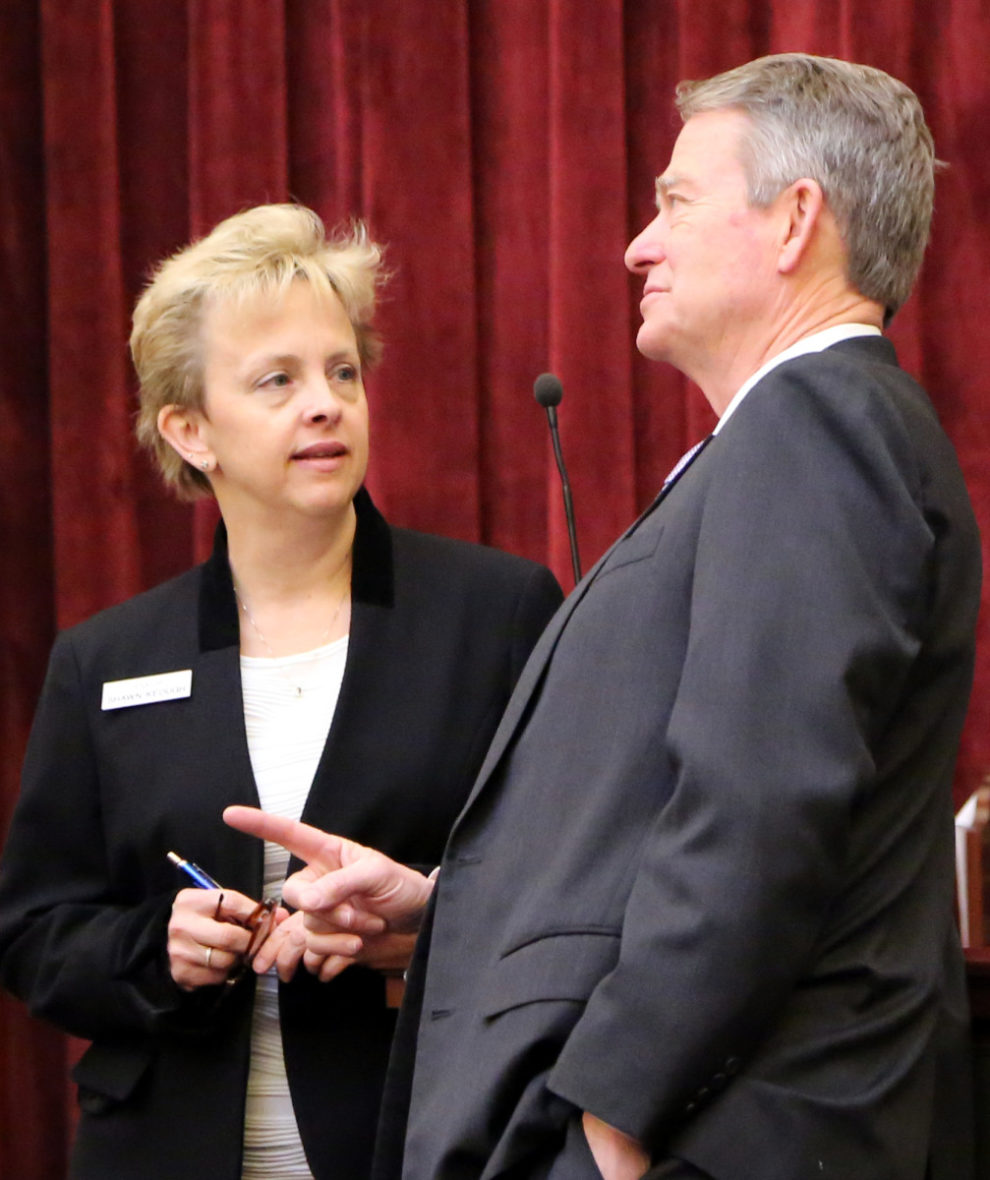

Sen. Shawn Keough is concerned about the equity issues between districts, although the problem isn’t easily solved. The Sandpoint Republican supported House Bill 1 in August 2006 — and like Little, she says the law empowered local voters to decide how much they were willing to support local schools.

She has heard the argument against supplemental levies — since districts can pass only one- or two-year levies, administrators cannot rely on the money as a stable, predictable funding source. But as co-chair of JFAC, Keough has to help write the state’s budgets every winter, so her sympathy for local school administrators only goes so far.

“Welcome to the rest of the world,” she said.

This series at a glance

Tuesday: Why we took a deeper dive into the tax shift

Wednesday: Tax shift of 2006 adds up to a tax increase

Wednesday: What the 2006 overhaul did to taxes in your district