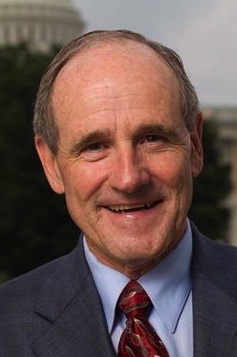

It didn’t take long for U.S. Sen. Jim Risch to remind me how I was earning a paycheck 10 years ago.

In August 2006, Risch was midway through a seven-month stint as governor, and brokering a deal to slash Idaho property taxes.

I was editorial page editor at the Idaho Statesman at the time — and our editorial board came out against his plan to eliminate $260 million in public school property tax levies, and use a $210 million sales tax increase to make up most of the difference.

That history wasn’t lost on Risch, even in 2016. When he called me on Aug. 6 to discuss the tax shift (yes, he did return a call on a Saturday afternoon during the midsummer congressional recess), he was quick to point out that the law received overwhelming support in a November 2006 advisory vote.

“You editorial writers may not have wanted it, but apparently the people did,” said Risch.

I don’t tend to write about what I wrote in my former life as an opinion writer. But as I look back at the 2006 tax shift — and its impact on education funding — full disclosure is in order.

On Wednesday, I will launch a two-day series on the effects and the politics of the tax shift, approved during a special one-day legislative session on Aug. 25, 2006. To write about this subject in 2016, and do it as objectively as possible, I’ve tried to let the numbers guide the project.

We analyzed what has happened in the past decade, in terms of property taxes, property values, education funding and student attendance. We emailed several of our key findings to the State Department of Education — specifically Tim Hill, the department’s school finance expert. We shared findings with stakeholders and politicians on both sides of the 2006 debate, including Risch himself.

We wanted to know upfront if our analysis was accurate and fair. And we wanted to make sure the key players had a chance to respond to our numbers.

On Wednesday, you’ll have a chance to see our findings. And on Thursday, we’ll look back at the politics that changed the way Idaho pays for its schools.

This series at a glance

Tuesday: Why we took a deeper dive into the tax shift

Wednesday: Tax shift of 2006 adds up to a tax increase

Wednesday: What the 2006 overhaul did to taxes in your district