Some members of the Idaho Supreme Court appeared skeptical Friday that the Idaho Constitution prohibits the state from funding private education.

Justices heard oral arguments in a lawsuit challenging the Parental Choice Tax Credit. GOP lawmakers and Republican Gov. Brad Little created the $50 million private school choice program through House Bill 93 last year.

A coalition that includes the Idaho Education Association and Moscow School District asked the Idaho Supreme Court to declare the program unconstitutional and block the state from implementing it. Thousands of students have already applied for the state funds.

On Friday, the five-member Supreme Court grilled the coalition’s attorneys from the get-go. Many of their questions focused on the central argument in the case: whether the Idaho Constitution’s mandate that the state fund a public school system prohibits it from also supporting private schools.

Article IX Section 1 of the Constitution says the Idaho Legislature has a “duty” to “establish and maintain a general, uniform and thorough system of public, free common schools.”

The “plain language” of this provision requires “a” system of public schools, said Marvin M. Smith, an attorney with Hawley Troxell, which represents the coalition. The coalition in recent months has argued that the tax credit funds a separate education system that’s private, tuition-based and not open to all students.

The coalition also contends the tax credit violates the “public purpose doctrine” implicit in the Idaho Constitution. This legal principle requires that the state spend taxpayer dollars in the public interest, not in private interests.

A few justices expressed doubts that Article IX Section 1 should be interpreted to rule out investments in education beyond the public system. Justice Colleen Zahn said she doesn’t “see anything” in the provision that would prevent it.

“I’m struggling with your argument,” she said.

The justices also asked about:

Standing

Zahn and Justice Gregory Moeller also probed whether the coalition has sufficient standing to challenge the tax credit.

The court’s historical standard for standing is that qualified petitioners must demonstrate a “real injury” from the law being challenged, Zahn said. But some members of the coalition have only pointed to a “hypothetical injury” tied to the tax credit.

Along with the teachers’ union and school district, the coalition includes two advocacy groups — the Committee to Protect and Preserve the Idaho Constitution and Mormon Women for Ethical Government — and several individuals. These include:

- Jerry Evans, former Republican state superintendent.

- Marta Hernandez, a public school teacher in Cassia County.

- Kristine Anderson, mother of two children with special needs in the Madison School District.

- Alexis Morgan, an Eagle mother of two public school children who says her daughter was rejected from a private school because of her family’s religious beliefs.

- Rep. Stephanie Mickelsen, a Republican lawmaker from Idaho Falls who voted against HB 93 during last year’s legislative session.

Asked which of these petitioners has the best claim to standing, Smith pointed to the parents who have already “suffered discrimination” from private schools. In briefs filed with the court leading up to Friday’s hearing, the coalition’s attorneys argued that public school enrollment — and state funding — will decline as a result of the tax credit.

Smith said Friday that state agencies, like the attorney general’s office, weren’t “willing and ready” to challenge the program.

“If not us, who?” he said.

What constitutes ‘maintaining’ a system?

Justices had fewer questions for the state’s attorneys, who argued that the Idaho Constitution “sets a floor” for supporting a public school system and not a “ceiling” that would limit other investments.

But Moeller dissected their claim that the tax credit doesn’t rise to the level of “maintaining” a separate system of schools.

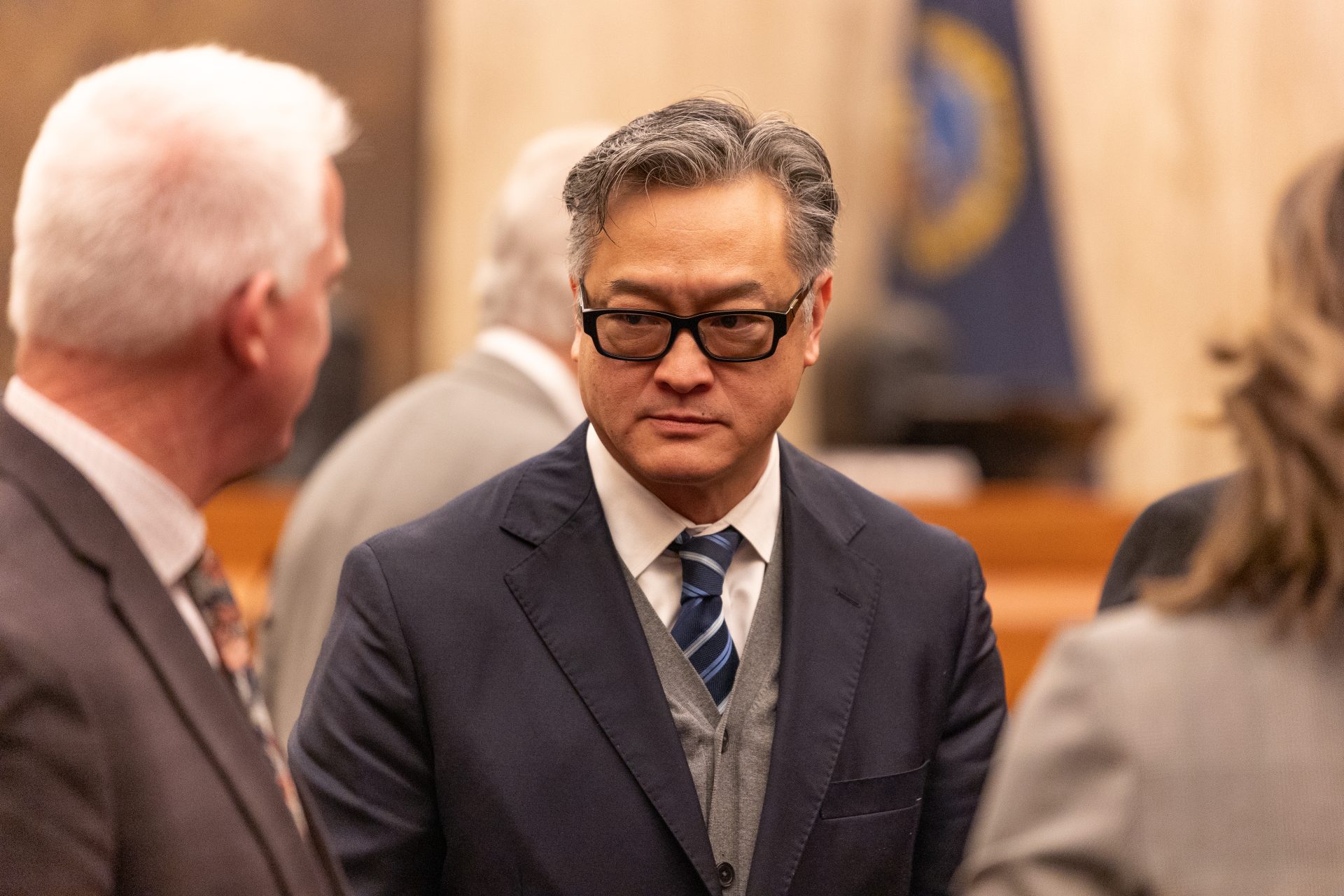

Attorney General Raúl Labrador’s deputy solicitor general, Michael Zarian, defended the State Tax Commission, the agency responsible for administering the Parental Choice Tax Credit. Jeremy Chou, an attorney from Givens Pursley, represented the Legislature, which intervened in the case.

Zarian told the court that the tax credit supports more than private school tuition. It also covers tutoring, books and other expenses for both private- and home-schoolers. The state reimburses parents, not schools, for these expenses.

“It’s not maintaining a system of schools,” Zarian said.

Schools must meet one standard to qualify as an eligible expense for the tax credit, however. The state will only reimburse expenses from private schools or home-school settings that are either accredited or maintain a portfolio that shows students are learning math, English, science and social studies.

Moeller wondered whether this requirement would constitute “maintaining” a separate system of schools. “The state plays absolutely zero role in ensuring the quality or the subject matter or the accreditation of any non-public school?” Moeller asked.

“That’s correct,” Chou responded. While teaching math, English, science and social studies is a condition of qualifying for the “voluntary” tax credit, it’s not a state regulation that private educators must follow, he said.

Idaho Launch

Justice Robyn Brody asked the coalition’s attorney how other programs would be implicated if the court agreed that the state only has a duty to fund public schools.

Brody pointed to Idaho Launch, the state scholarship that covers tuition at both public and private colleges, universities and workforce training programs.

The coalition’s challenge only considers K-12 funding, Smith said, while Idaho Launch deals with higher education. But Brody said the court should consider other programs as well.

“Isn’t that part of our job?” she said. “To look at, what are the ripples across the pond that our decision will have?”

Thousands have applied for tax credit

Applications for the tax credit opened Jan. 15.

As of Wednesday, the Tax Commission had received more than 4,650 applications covering more than 7,300 students, according to a news release from the agency. Many applications made claims for multiple students per household.

The application window will remain open through March 15, “unless a law change or court order halts the program,” a Tax Commission spokesperson said in a news release. It’s unclear what would happen with the applications if the Supreme Court halts the program.

A district court judge in Utah last year declared the Beehive State’s private school choice program unconstitutional. The teachers’ union there challenged the Utah Fits All Scholarship on similar grounds to the Idaho coalition’s case against the Parental Choice Tax Credit — that public dollars are reserved for public schools.

The Utah judge, Laura Scott, didn’t issue an injunction, however. She allowed the $100 million program to take effect as the state appealed her ruling to the state Supreme Court, KPCW reported. The appeal is ongoing.

But the Idaho Supreme Court’s ruling — whenever it comes — should be the final word on the coalition’s challenge to the Parental Choice Tax Credit. The U.S. Supreme Court typically doesn’t hear cases that center on state constitutions.