AMERICAN FALLS — Lawmakers and school leaders shared their fears and frustrations over Idaho’s new $50 million private school tax credit program at a town hall event Monday, and called on voters to pay attention, start conversations and support pro-public education candidates.

Dozens of community members filled American Falls’ senior center for the event, seeking answers about how the tax credit works and what it will mean for Idaho’s public students. It was the first of seven East Idaho town hall events, organized by the nonprofit Save Our Schools.

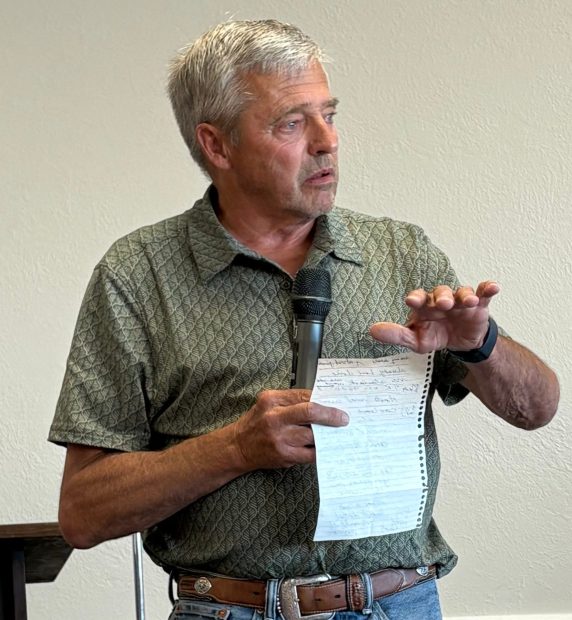

Rep. Dan Garner, R-Clifton, said the tax credit is part of a broader attempt to defund public schools: “There is actually a war or a battle going against public education. They’re wanting to do away with it.”

“It scares me to death,” Garner said. Garner is one of 19 House Republicans who voted against House Bill 93, the private school tax credit law.

The tax credits are “contrary to the Constitution,” said Sen. Jim Guthrie, who was one of nine Senate Republicans to vote against the bill. “I don’t think there’s any doubt about that.” The Idaho Constitution charges lawmakers with establishing and maintaining “a general, uniform and thorough system of public, free common schools.”

Those were a few in a long laundry list of concerns with the tax credit program — from the outside “dark” money coming into the state, to the lack of accountability for private schools, to the impact on rural school districts.

The private school tax bill passed after years of advocacy led by Sen. Lori Den Hartog, R-Meridian and Rep. Wendy Horman, R-Idaho Falls. Supporters have celebrated the bill’s passage as a win for families who want to educate their children outside the public school system, which includes traditional and charter schools.

Gov. Brad Little approved the private school choice measure — even after receiving more than 30,000 messages calling for a veto — amid pressure from President Donald Trump, and with a looming primary election.

The tax credit program would provide families with $5,000 per each student enrolled in private school, or home-schooled. Special education students would receive $7,500, and the program is currently capped at $50 million.

Impacts on rural schools

Rural students’ access to private schools is more limited than urban students, so they are less likely to use the tax credits, unless their parents choose to home-school them. Because of that, tax credit opponents say it is an unfair system.

“We’re going to end up subsidizing urban private education while our rural schools struggle,” said Heather Williams, director of the Idaho Rural Schools Association.

“Folks in my hometown wonder why their taxes have to subsidize private school in Boise, because that’s essentially what’s happening,” said Rep. Soñia Galaviz, D-Boise, who is from the Silver Valley in northern Idaho.

The private school choice tax credit program will mean a decline in state revenue of up to $50 million, and opponents worry that figure will expand to hundreds of millions of dollars over time, as it has in states like Arizona. And those declines will likely lead to cuts to state budgets across the board, opponents say.

It’s not “about politics. It’s about our priorities as Idahoans,” said Brady Garner, assistant superintendent of Preston School District. “I feel strongly that vouchers can cause harm to our small, rural town schools.”

Related reading: Low-income students, religious schools, urban areas: Who will benefit from a school choice program?

Panelists cite concerns over tax credits’ fiscal impacts, lack of accountability

While state agency heads, including the state superintendent, are being asked to submit budgets with up to 6% cuts, the $50 million private school tax credit program will remain intact, panelists pointed out.

For the Preston and American Falls school districts, a 6% cut would be about $1 million. And that would likely mean going back to voters for a levy to support the schools, said Brady Garner.

Related reading: Budget holdbacks ‘not necessarily expected,’ Education department says

The tax credit will contribute to further declines in state revenue and more cuts, opponents say.

And it will financially harm public schools in other ways. If more students exit the public school system, the district loses the state dollars attached to each child.

Brady Garner said he’s noticed another interesting trend: some families are hoping their children qualify for special education, because they would get the higher tax credit of $7,500.

Public school districts remain responsible for assessing those children for special education, which comes at a cost. A handful of non-public school families have already reached out to Preston School District for special education assessments, Brady Garner said.

At the same time the state is investing in private school students, students in the public school systems are underfunded, Williams said, mentioning the state’s growing special education funding gap.

And the program will primarily benefit the wealthy, Guthrie said. Because the tax credit may not fully cover private school tuition, private education could remain out of reach for low-income families.

Another sticking point: Private schools don’t have to administer state tests or share student achievement results, Brady Garner said, so it’s impossible to track whether they are adequately educating students. Private school leaders also don’t have to abide by transparency and open meetings laws.

“It’s really scary that this money can go to private schools where there just literally is no accountability,” Jensen said, adding that private schools can deny a student’s enrollment for any reason.

Private schools can even teach concepts some state lawmakers have fought to keep out of Idaho schools, such as Critical Race Theory and diversity, equity and inclusion, Guthrie said.

Out-of-state influence: ‘That’s not the Idaho way,’ superintendent says

During the May 2024 primary, groups from outside of Idaho spent tens of thousands of dollars on negative ads attacking candidates who opposed private school choice — including Rep. Rick Cheatum, R-Pocatello.

Randy Jensen, the American Falls superintendent, said flyers attacking Cheatum were filled with “lies and mistruths.”

Cheatum survived the attacks and was reelected, but he and others who voted against the tax credit know they now have a target on their back and will face mounting pressure to back the program.

“It scared me a lot, that they’re willing to come in and buy elections,” Jensen said of outside groups. “That’s not the Idaho way.”

Next steps for public education supporters

One schoolteacher who attended the town hall raised her hand and pushed for solutions on how to fight back against the tax credit program.

Brady Garner said being aware and paying attention helps — many people did not understand the nuances of the tax credit during this past legislative session, he said. Now, as proponents will likely push to expand the program, people need to be informed.

The town hall was the start of a conversation that community members should continue with their friends and neighbors, he said. “Don’t let this die here.”

Galaviz urged attendees to sign a petition against vouchers, and to identify and support pro-public education candidates.

“We will stand together and we will recalibrate this state,” she said. “I can feel it.”

At the end of the meeting, Dan Garner said it reminded him why he remains in politics. “You’ve recharged my battery tonight.”

Related reading

Upcoming town halls to highlight ‘harms’ of House Bill 93

Retired public school administrators campaign against private school tax credit

PLUS: Check out our private school choice page to learn more.