As a trustee on the district 271 school board in Coeur d’Alene, I spend substantial time thinking about how to lower the property tax burden in our district while also ensuring our public schools have the financial resources they need to provide excellent educational resources and opportunities to our students.

I suggest that the legislature consider widespread property tax relief by updating the homeowner’s exemption program. Over the last few years residential real estate valuations have increased substantially in Idaho. However, the homeowners exemption program has not kept up. Changes to code in 2016 combined with rising property values have diminished the effectiveness of this program. By allowing this program to lose its effectiveness, our state has shifted a higher share of property taxes onto those that own and live in their Idaho homes.

Let me share an example. In 2005, our family purchased a house in Kootenai County that was very close to the median home value at the time. By the time we sold in 2019, this home’s value had increased substantially but had still fallen a little below the median house value. This house is representative of the experience of many long-term homeowners in my community. (Median values from Single Family Median Sales Price graph found at kcgov.us)

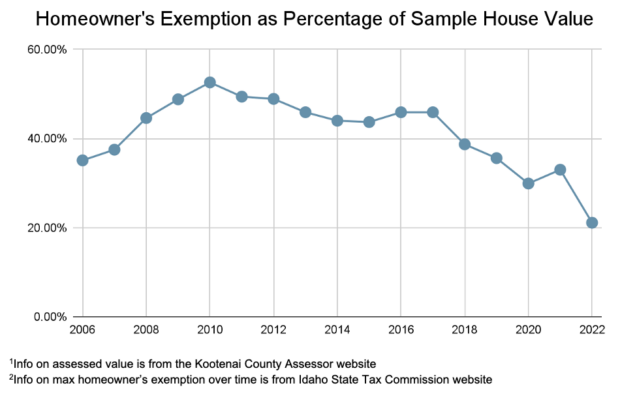

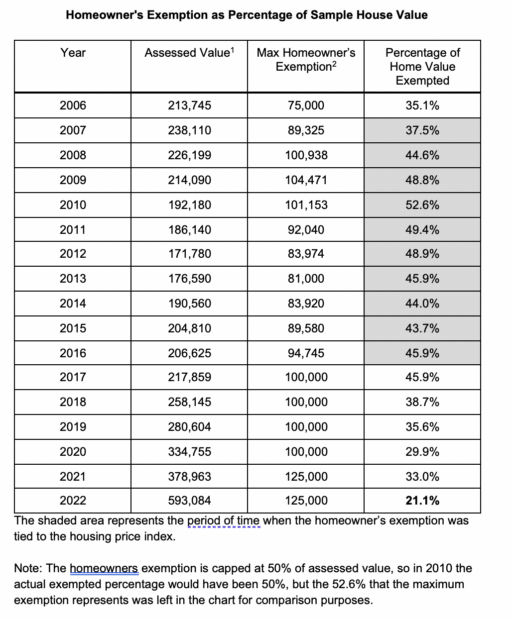

From 2006 through 2022, the tax relief provided by the homeowner’s exemption has varied widely on this house. For many years 40-50% of the home value was exempted. However, that percentage has fallen quickly for the last 5 years. The max homeowner’s exemption was increased in 2021 but continued rises in property values quickly offset that change. For the year 2022, the portion of home value exempted was a low of 21.1%. The impact of the homeowner’s exemption for this home has fallen from 1/2 of the house value to barely over 1/5. This widespread trend has led to homeowners with median homes paying a larger share of property taxes while vacation homes, rental properties, premium properties, and commercial properties pay a relatively smaller share. Even with no rise in dollars collected by taxing districts, this trend means that homeowners will see an increase in their property tax bills as residential property values increase.

In 2006, the Idaho legislature passed a bill that tied the homeowner’s exemption to the housing price index for the state with an adjustment each year. Then in 2016 a bill passed that removed the adjustment and established an upper limit of $100,000 for subsequent years (increased to $125,000 in 2021). By removing the yearly adjustment, the property tax relief provided by this program has significantly decreased even as the residential house values in Idaho have grown at unprecedented rates.

Idaho is a diverse state with tremendous variety in housing markets, so I would urge the legislature to tie the homeowners exemption to the median assessed house value in each county rather than a state-wide index or maximum. This would help future-proof the program by allowing the exemption amount to adapt over time as home prices change. An adjustment by county would also account for differing housing markets found across the state.

The state legislature should also provide more state-level funding for schools, thus lowering the amount of taxes collected by schools through property taxes. The legislature could help both our schools and property owners by providing a funding source for new and updated school building needs. Currently the only option for school construction projects is a voter approved bond funded by local property taxes. This is a significant issue given the growth our state is experiencing as well as the age and condition of our school buildings. Other ways the legislature could reduce reliance on local property tax funding for schools is to increase operational funding for programs such as special ed, safety and security, maintenance, teacher pay and classified staffing. A state as successful as Idaho shouldn’t be at the very bottom of per-pupil state education funding.

There are several possible modifications to property taxes which I hope the legislature will consider this session. The change proposed here would reconfigure the homeowner’s exemption to provide more meaningful tax relief to homeowners without requiring any additional money from the state. For this program to work well now and in the future, we should tie the exemption amount to the median assessed home value in each county with an automatic adjustment each year.

1Info on assessed value is from the Kootenai County Assessor website

2Info on max homeowner’s exemption over time is from Idaho State Tax Commission website