For now, the 60,000 students attending Idaho’s three largest universities will not experience reduced faculty, fewer services or increased tuition as the cost of purchasing goods and providing services rises at record levels.

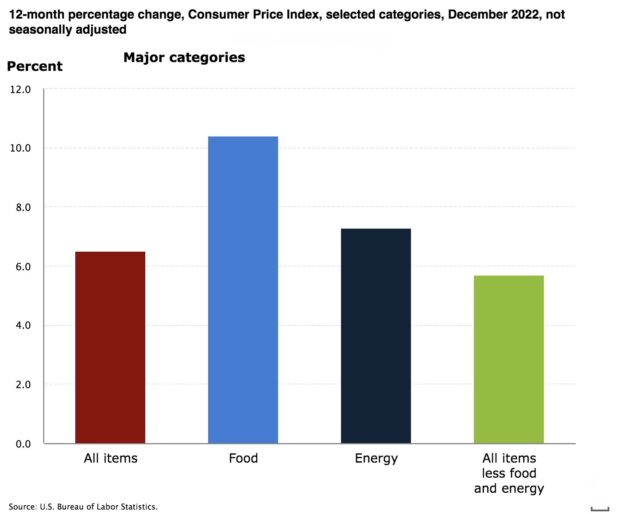

Boise State University, the University of Idaho and Idaho State University will have to find ways to cover higher costs associated with inflation — projected to be in the millions of dollars — for services like keeping the lights on, maintaining computer networks and supplying food staples like eggs.

For solutions, they are counting on leadership at the State Board of Education and state lawmakers — specifically, to approve Gov. Brad Little’s proposed budget, which is recommending an increase in higher education funding.

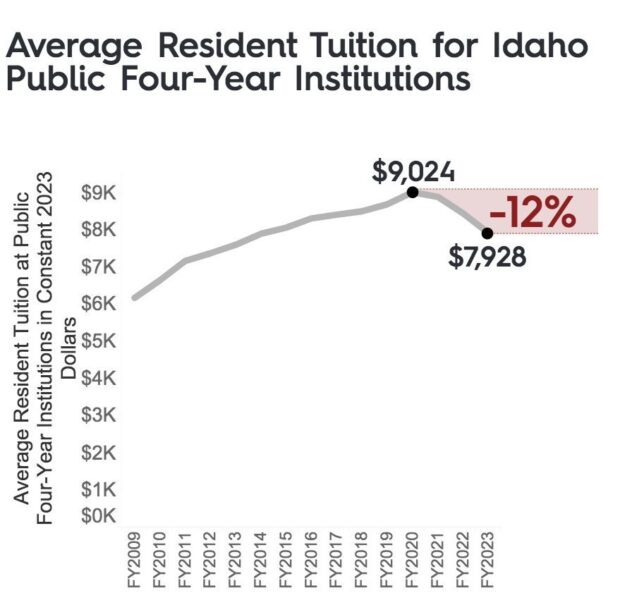

The three Idaho universities told EdNews that a tuition increase is not a certainty. But they haven’t raised tuition in three years. And the State Board could take up the issue in April.

State Board spokesperson Mike Keckler said, “The presidents will have much more to say about this during the April board meeting. That’s when budget matters are discussed in detail, including possible tuition increase requests, should those come forward.”

BSU says the school is committed to making sure the effects of inflation aren’t felt by students in the classroom. “We are always looking for ways to be more efficient,” said spokesperson Mike Sharp.

To cut costs, the colleges could reduce the number of faculty or staff, cut back on programs, or increase class sizes. Or, like other universities have already done, request a tuition increase.

“We don’t like tuition or fee increases as they affect access for our students and our best value ranking, but those considerations have to be offset against the need to provide sufficient faculty and staff support to our students,” wrote U of I spokesperson Jodi Walker.

ISU suggests more collaboration with state leaders, but in the meantime the school is reviewing “revenues, institutional reserves, and strategic allocation of resources” for ways to handle growing costs.

The cost of utilities, food and information technology at ISU grew by a combined $2.6 million between fiscal years 2021 and 2023. And they still have to contend with fuel, supplies, maintenance contracts, insurance and construction.

The situation is similar at BSU. Sharp reports that utility costs have risen by $1.1 million dollars, insurance $300,000, software $500,000 and service contracts are expected to increase by $2 million.

“We are seeing more students struggling with basic needs such as food and housing. Increases in area housing costs have resulted in a shortage of affordable housing for students. Traffic in our food pantry has also increased,” said ISU spokesperson Emily Frandsen.

Students are also responding by passing up internships and employment opportunities connected to their career field to take higher paying jobs off campus.

Those alternative job choices, Frandsen said, “are not developing career skills” for their chosen professions.

U of I is experiencing a similar phenomenon. Off-campus wage inflation makes it difficult to fill positions in student services, Walker said. For example, math tutors make $12 an hour but the service industry is paying $15 an hour.

“One hundred percent of our students are required to take math to earn their degrees. A shortage of math tutors affects all students, but especially those in STEM fields who need to pass numerous upper division math classes to thrive in future careers,” Walker said.

Between fiscal years 2018 and 2022 at the U of I, the cost of operating its library, maintenance contracts and paying insurance grew by $2.25 million. Walker said the examples provided “are just illustrative of the overall impact of inflation, which we calculated to be $20 million in operating expenses, excluding research.”

In the short term, students should not expect to see any changes on campus, according to the universities. But the long-term outlook is not as clear, because operational costs are not expected to decline this year, and those costs have to be absorbed.