SANDPOINT — Hundreds of Lake Pend Oreille seniors were greeted with a stark message Friday morning — “welcome to your financial future.”

The annual personal financial fair combines a little tough love with a heavy dose of reality. Sandpoint, Clark Fork and Lake Pend alternative high schools attended.

Here’s the simulation: You’re 28 years old, maybe married, maybe with kids, and you’ve landed a job. You also have goals, obligations and bills. Now you need to budget.

“They need to learn this information, so I think it’s something that our community is very committed to,” said Jeralyn Mire, a post secondary counselor at Sandpoint.

With the help of local businesses and dozens of volunteers who set up 10 merchant stations, students navigated a handful of spending decisions adults know all too well: food, housing, children and transportation. Properly managing debt and learning about borrowing were major aspects of the experience.

“You are eating everything that’s organic, you are gluten free, you like those ribeye steaks. It’s amazing right? That’s your high-end food. Then at the bottom is store brand stuff. You’re eating some hamburger, ramen noodles — you’re eating, but it’s just not like that super-awesome really expensive food,” a volunteer at the My Food station explained.

They also considered the number of times they eat out. “Do those jitter girls know your name and your order when you roll up?” she asked, referencing coffee purchases.

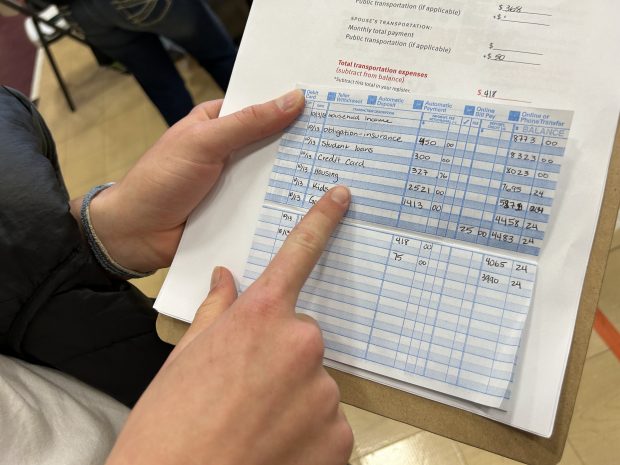

In their personal workbook, students selected a grocery and dining-out plan, subtracted that total from their balance and moved on to consider fun activities, like movies, concerts or vacations. As they visited each station, they subtracted spending from their salary. The goal is to have $100 at the end.

Clark Fork senior Cole Mintkin, 18, was given the persona of a cook. He and his wife had a combined after-tax monthly income of $5,085.

“I’m broke,” Mintkin said, complaining that he received a repair bill for his favorite recliner in the amount of $425.

Carson Yetter, also a Clark Fork senior, was shocked at childcare costs. As a pilot married to a receptionist, they have an income of $7,400.

“I found out that my childcare is $1,400. I was like, ‘What? I have an eight-month-old. Who’s taking care of that child?’” Yetter said.

Students blurted out a few odd or funny comments:

- One student said her 3-year-old daughter Brianna is “so expensive.”

- Another student said “I’m gonna get a bicycle,” when asked how he planned to get around.

- One teenager was pretty frugal because he selected “the cheapest options everywhere.”

- Someone else said childcare costs a lot more than expected. “Oh yeah, I’m definitely going to wait.”

They could choose to speak with a financial advisor to evaluate spending and determine savings goals. They also participated in a trivia game show about money lessons. And at the end of the day, their workbooks were audited. Those who fully participated were eligible for donated prizes.

“It’s a special day for our seniors. They like it. You can see by the way they’re engaged. They want to learn this knowledge,” Mire said.

For Sandpoint, the financial day supports the classroom, Mire said. Seniors experience first-hand lessons taught in their economics and personal finance class: student loans, the average cost of a house, down-payments, loans rates, retirement topics and taxes. In Idaho, learning financial literacy is considered a core skill. House Bill 92 passed in the 2023 legislative session requires high school graduates to have one semester of a personal financial literacy course.

“I think it’s just an experience that they remember,” Mire said.