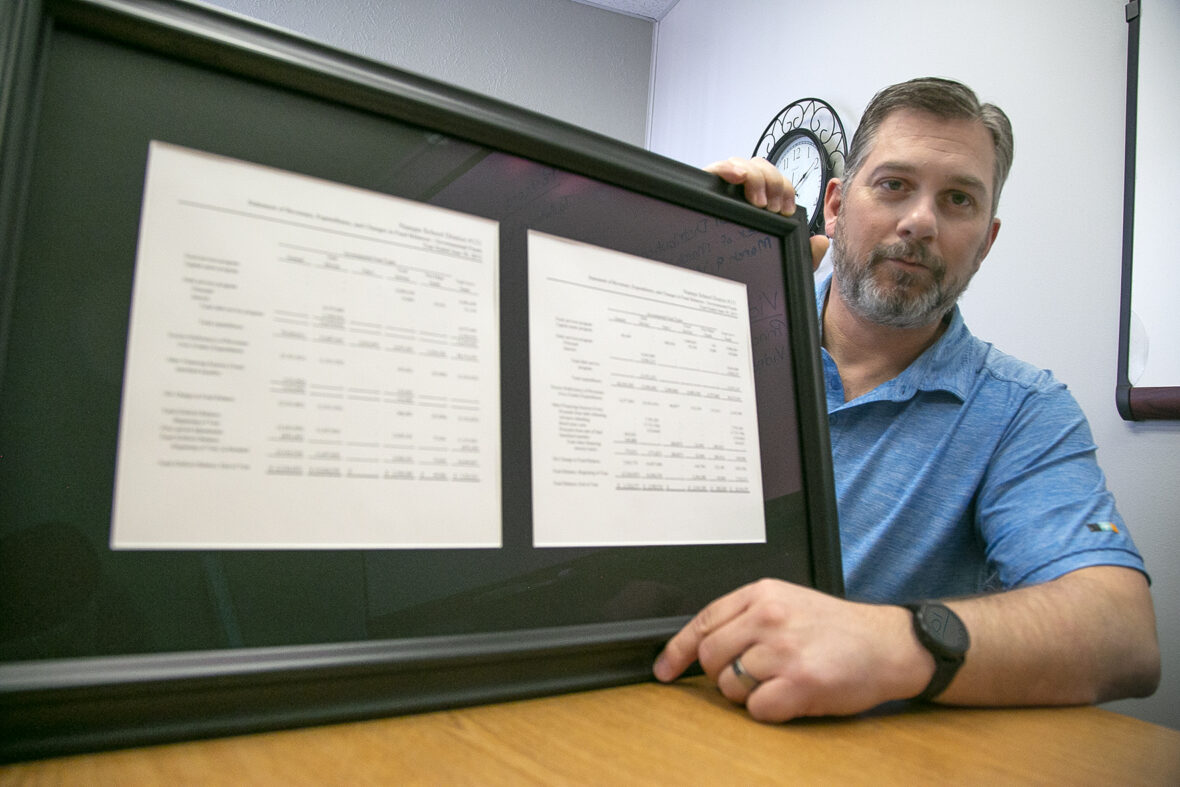

A framed audit hangs on the wall in the Nampa School District’s finance department.

To an outsider, the neat rows of numbers wouldn’t mean much. But for Nampa staff, the 2014 budget document is both a stark reminder of the district’s recent financial turmoil, and a symbol of how Nampa pulled together to dig the district out of a financial crisis.

That year, Nampa went from $5.3 million dollars in debt, to having a $1.72 million surplus.

“We had all these people that helped the district,” Finance Director Randy Dewey said. “The patrons and everybody helped us get back into the black.”

Six years later, Nampa’s finances are stable. The district has amassed $4.5 million in flexible savings, and put a new policy in place intended to keep that rainy day account at 5 percent of the district’s revenue.

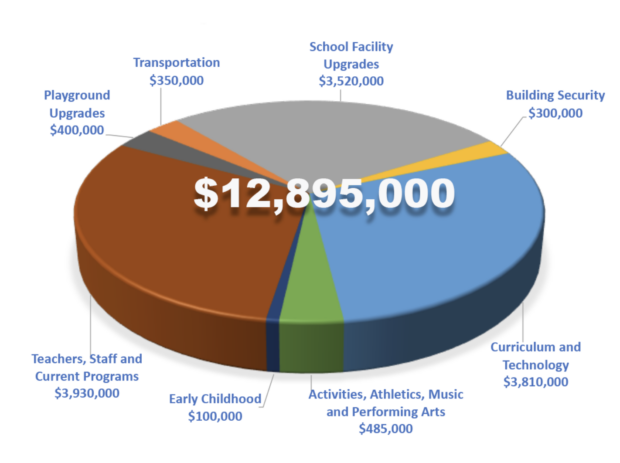

But district officials worry that a rainy day could be on the horizon, if taxpayers don’t approve a supplemental levy on the ballot next week. Nampa is asking taxpayers to foot a $12,895,000 two-year levy, to replace the district’s current levy that expires this year. The funds would pay for everything from roof repairs to salaries and free busing for student activities.

This is Nampa’s second attempt at getting the levy passed. Last fall, a similar levy failed by 11 votes.

“I haven’t slept in weeks,” district spokeswoman Kathleen Tuck said in an interview last week. On the whiteboard in her office she’d made a list of all the posters, flyers, social media posts and other advertisements the district had planned to get the word out to voters.

“If we don’t pass this (levy), we don’t have another one before we have to set our budget,” Tuck said. “There’s just a lot at stake here.”

Turmoil in the rearview mirror

In 2013, Nampa was deep in debt.

Dewey traces the issue back to the Great Recession.

When the Recession hit, and the state cut down on spending for education, most districts coped by making cuts or instituting furlough days. Nampa, however, thought it had a “good enough cushion” to weather the storm without cutting too deep.

Dewey, who was a school auditor before he joined the Nampa district, remembers other districts coming to him, asking if he knew Nampa’s secret.

“We really want to know how they can keep this up,” Dewey remembers them asking.

As it turns out, Nampa couldn’t.

The district continually chipped away at its savings. By 2012, Nampa was spending money it didn’t have, in part because of budgeting errors like overestimating revenues. By the end of fiscal year 2013, Nampa was $5.3 million in debt.

To remedy the issue, the district went into “lockdown” mode, Dewey said. Substitute teaching and classroom supply budgets were cut to the bone. The district closed an old elementary school and left 50 teaching jobs unfilled. Teachers and administrators took 14 furlough days.

To pay salaries, Nampa had to ask a local bank to give the district a loan on the payments it would receive from the state. And taxpayers agreed to take on a $4.3 million supplemental levy to help dig the district out of its hole.

During the budget crisis, longtime district superintendent Gary Larsen resigned, and the district juggled four leaders in the span of two years.

“It was a turning point for our district,” Dewey said. “We changed leadership, there were a lot of teachers that left and we had a lot of upset patrons. It was really years of bringing that back.”

Since 2014, the district has gradually improved its bond rate and rebuilt its savings, called a fund balance. Last year, Nampa ended with a fund balance of $9 million — one of the largest in the state, but far behind districts like Idaho Falls and Boise, which had more than $17 million each.

District leaders say they want to keep 5 percent of revenues as flexible savings that can be spent as the district sees fit. With about $4.5 million of that fund balance set aside as “unassigned,” the district currently sits right above that 5 percent mark.

That savings helped the district weather a storm in 2018, when the district’s enrollment was far lower than projected (largely because new subdivisions were made up of empty-nesters where the district expected families).

“Because we had that fund balance, we were able to weather almost a million dollar loss,” Dewey said.

The district’s next ask

Supplemental levies, Tuck says, are a misnomer.

Nampa isn’t relying on taxpayer help to fund supplemental things, she said. Instead, the levies cover basic needs like curriculum, teachers and technology.

But, with few other ways to generate revenue outside of state funds, Nampa and other districts rely on taxpayer support to provide for the community’s kids. On March 10, 41 districts will ask taxpayers to fund levies.

“Nobody wants that, we just don’t have options since that’s the way the state funds education,” Tuck said. “I don’t think you could go to a single school district and they would say, ‘This is the way we like it, this is the way it should be.'”

Nampa, one of the state’s largest districts, typically has high support for levies. According to the Idaho Press, voters had supported Nampa’s levies every year since 2009, until they struck down the 2019 levy ask.

Tuck thinks November’s levy failure had to do with changes to ballot language, property tax fatigue, and apathy among voters who assumed the levy would pass.

After the failed ask, the district surveyed 120 people about the levy. The 14 survey respondents who voted “no” said they thought property taxes were too high, didn’t think the levy was their responsibility, and didn’t think a supplemental levy should be permanent.

Tuck said she isn’t aware of any organized opposition to the upcoming levy. Critics have mostly emailed questions or spoken out on social media, she said.

This time, to sweeten the deal, Nampa is asking taxpayers to pay a lower rate than they paid on the last supplemental levy. If Nampa taxypayers approve the new levy, they’re expected to pay $65 less, per every $100,000 of home value, compared to what they paid in 2019.

“What we can control is what we ask for,” Dewey said. “We’re really trying not to make you pay a dime more.”

Are you a Nampa voter? Calculate how the levy would influence your property taxes by pasting this link into your browser: http://128.177.112.160/nsdcalculator/