By the narrowest of margins, the House has passed a bill granting $10 million in income tax credits to people or companies who donate to private school scholarships.

The margin was 35-33 — which means that, had only one supporter switched sides to vote no, House Bill 286 would have failed on a tie vote.

The measure now heads to the Senate.

HB 286 would allow donors a dollar-for-dollar credit for contributions to scholarship granting organizations, or SGOs. These organizations, in turn, would award scholarships to students from families that meet income guidelines.

The objective, say supporters, is to open religious and nonsectarian private schools to new students who would be otherwise unable to attend.

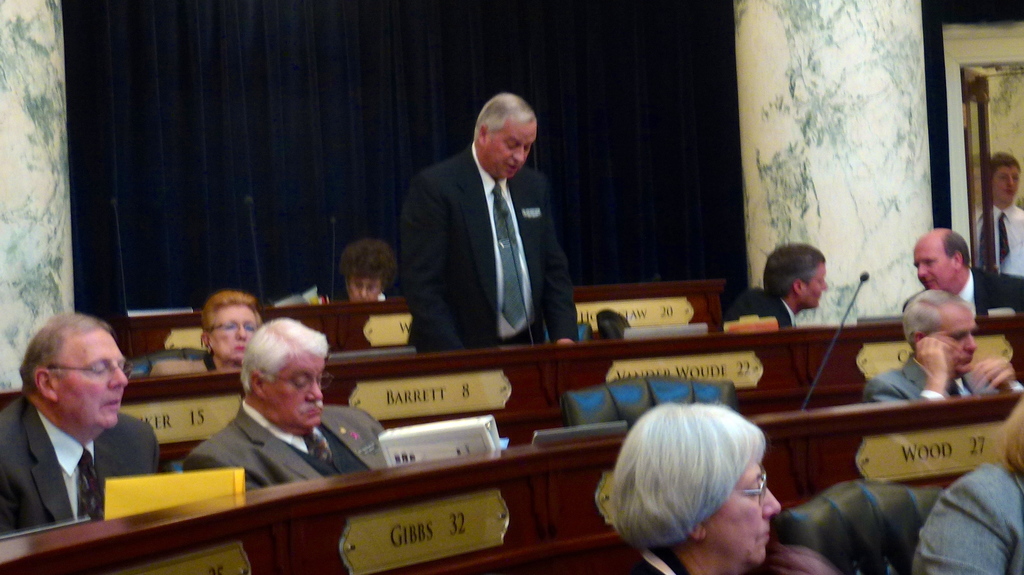

“Everybody talks about choice,” said Rep. Mark Patterson, R-Boise, “but this is a bill that actually creates choice.”

Much of the debate centered on constitutional issues. Supporters argued the bill meets constitutional muster, since there is no direct transfer of money from state coffers to private schools. Rep. Mat Erpelding, D-Boise, cited language in the state Constitution that prohibits any unit of government from supporting or sustaining church schools.

But much of the debate centered on mechanics.

The bill touts potential savings of $5.8 million, $3.3 million for the state and $2.5 million for local school districts. Even after awarding the tax credits, the state would be able to reduce payments to public school districts — payments that are based on average daily attendance.

But even sponsor John Vander Woude, R-Nampa, conceded that the local savings are not a sure thing, since local school spending is not tied to attendance.

House Minority Leader John Rusche, D-Lewiston, said the districts’ staffing and fixed costs will not decrease, even if some students leave for private schools. “I have a great deal of difficulty understanding how the bill achieves any savings.”

With the tax credits capped at $10 million, they would be made available on a first come, first served basis. The State Tax Commission would need to approve each credit, regardless of size, to ensure the credits remain under the cap.

Rep. Lynn Luker of Boise — one of a handful of Republicans who joined several Democrats in debating against HB 286 — labeled this process “cumbersome.”

How they voted

Yes (35 Republicans, 0 Democrats): Anderst, Barbieri, Barrett, Bateman, Batt, Boyle, Collins, Crane, Dayley, DeMordaunt, Denney, Gestrin, Harris, Hartgen, Holtzclaw, Horman, Loertscher, Malek, McMillan, Mendive, Monks, Morse, Moyle, Nielsen, Palmer, Patterson, Raybould, Shepherd, Sims, Thompson, Trujillo, Vander Woude, Wills, Wood (35), Youngblood.

No (20 Republicans, 13 Democrats): Agidius, Anderson (1), Anderson (31), Andrus, Bedke, Bell, Bolz, Burgoyne, Chew, Clow, Erpelding, Eskridge, Gannon, Gibbs, Hancey, Hixon, Kauffman, King, Kloc, Luke, Meline, Miller, Packer, Pence, Perry, Ringo, Romrell, Rusche, Smith, Stevenson, VanOrden, Ward-Engelking, Woodings

Absent (2 Republicans): Henderson, Wood (27)