A bill addressing Internet sales taxes is on its way to the House floor — where it could become tied up in late-session haggling over tax cuts.

Several members of the House Revenue and Taxation Committee praised the underlying motive behind House Bill 581: leveling the playing field between brick-and-mortar retailers and online competitors.

But several committee members also had a catch. They want tax cuts to offset any new dollars collected from the Internet sales taxes. That’s one reason Rev and Tax sent the bill to the amending order, on an 11-4 vote.

Supporters of Internet sales tax bills have argued that the tax could provide millions of dollars of new money for K-12 and other state programs. But the tax impacts of HB 581 are open for debate.

The bill’s “fiscal note” makes no attempt to estimate the possible impact on state coffers. The bill is designed to tighten up the definition of retailers that would be subject to collecting sales taxes on e-commerce. Until the law is in place, there’s no telling how much new money might come in to state coffers, said Rep. Lance Clow, R-Twin Falls, the bill’s sponsor.

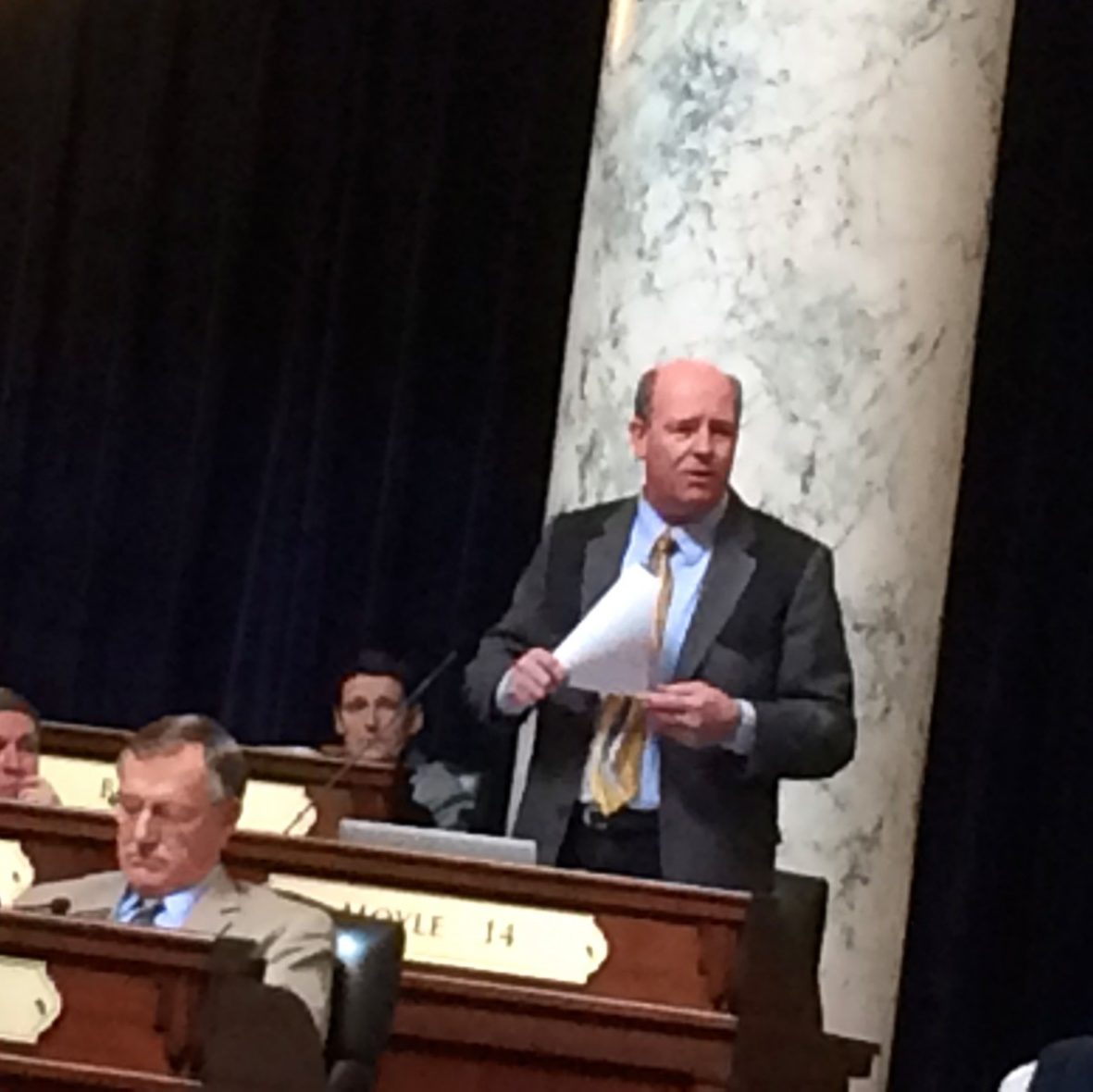

House Majority Leader and Rev and Tax member Mike Moyle wasn’t convinced. He believes the bill could generate at least $10 million in new tax revenue, so tax cuts should be part of the equation.

“I believe some of that money ought to go back to the taxpayers,” said Moyle, R-Star.

Friday’s developments add another wrinkle to the seemingly annual end-of-session jockeying over tax bills.

In early February, the House passed Moyle’s bill to cut income taxes and increase grocery tax credits. The $27.8 million measure has languished in the Senate Local Government and Taxation Committee since then. The committee’s chairman, Jeff Siddoway, R-Terreton, has said he doesn’t want to look at tax relief until he believes K-12 has been adequately funded.

Here’s the committee roll call on sending HB 581 to the floor for amendment:

Yes: Robert Anderst, R-Nampa; Greg Chaney, R-Caldwell; Gary Collins, R-Nampa; Thomas Dayley, R-Boise; Stephen Hartgen, R-Twin Falls; Moyle; Ron Nate, R-Rexburg; Dell Raybould, R-Rexburg; Dan Rudolph, D-Lewiston; Heather Scott, R-Blanchard; Jeff Thompson, R-Idaho Falls.

No: Neil Anderson, R-Blackfoot; Mat Erpelding, D-Boise; Clark Kauffman, R-Filer; Mark Nye, D-Pocatello.

In other Statehouse action Friday:

Broadband access. The House Education Committee passed two bills designed to help local school districts secure broadband Internet in a post-Idaho Education Network world.

Senate Bill 1333, would create the Broadband Infrastructure Investment Grant (BIIG) fund. The BIIG fund would be used to invest in construction projects for high-speed broadband connections to benefit e-Rate-eligible schools and libraries.

E-Rate, administered by the Universal Service Administration Company. uses phone bill surcharges to help schools and libraries pay for Internet access.

Senate Bill 1334 would create an Education Opportunity Resource Committee. The bill also directs state resources to help school leaders navigate the e-rate program and contracting procedures as they pursue local broadband services.

Both bills passed on voice votes, and head next to the House floor with recommendations they pass. Both bills passed the Senate 33-0 on Feb. 29.

Idaho Ed News reporter Clark Corbin contributed to this report.