The perennial debate pitting tax cuts against education funding is headed back to the House floor.

Voting along party lines, the House Revenue and Taxation Committee endorsed a $51.2 million proposal to cut income taxes. That means House Bill 67 could come up for a House vote, perhaps later this week.

If Tuesday’s committee debate is any indication, the floor debate is likely to circle back to K-12 funding — and the question of whether a state tax cut will force Idaho schools to continue their reliance on supplemental property tax levies.

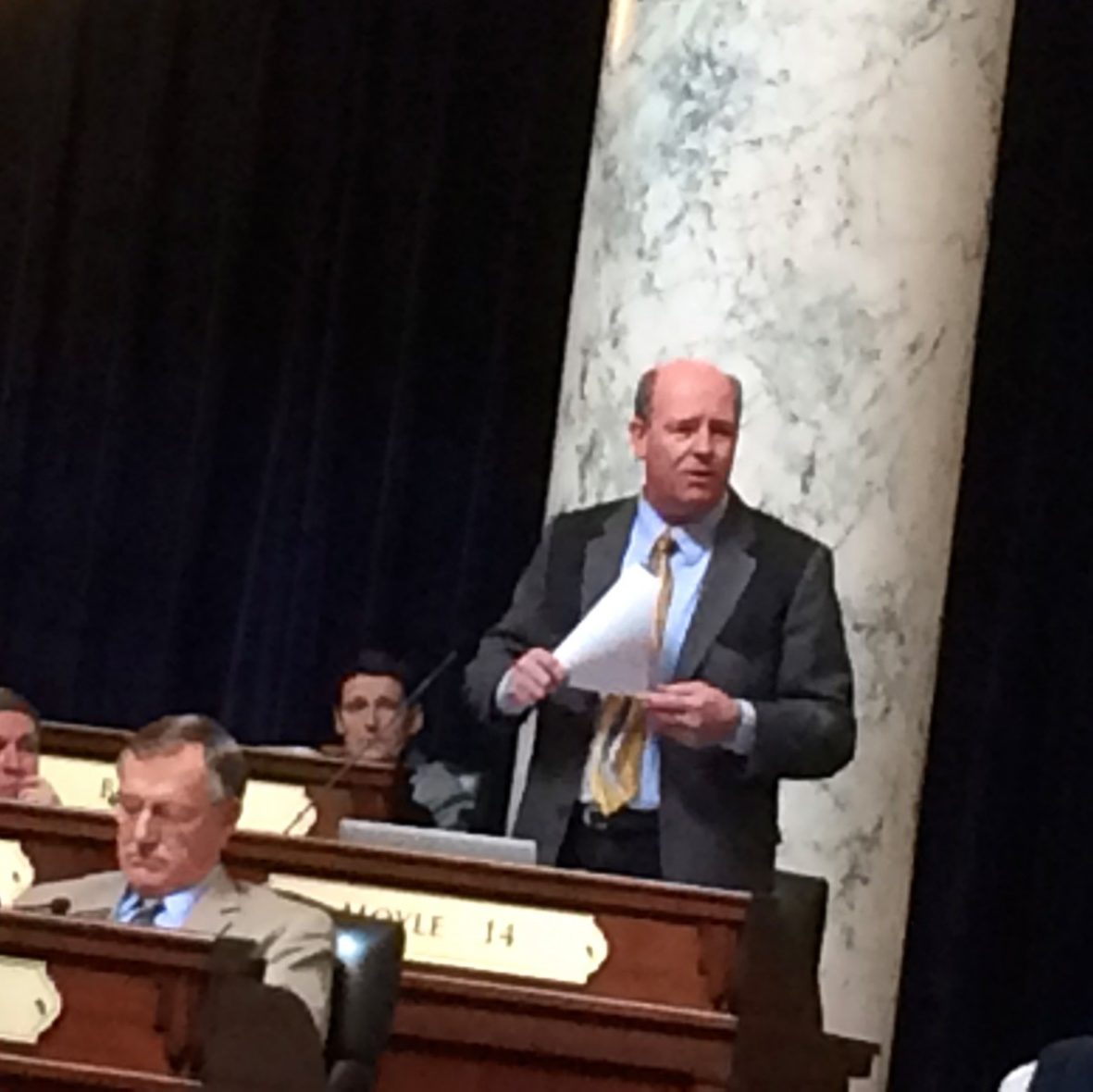

The bill’s author, House Majority Leader Mike Moyle, downplayed the effect on K-12 funding, pointing out that Gov. Butch Otter’s 2017-18 budget proposal leaves a cash balance of $68 million.

“There’s plenty of room for us to take care of education,” said Moyle, R-Star.

Earlier this month, Otter proposed a $101.4 million increase in K-12 funding. His budget did not include an income tax cut — but the governor has said he’ll keep an open mind to tax bills if they pass both houses.

Testimony and committee debate Tuesday was fairly predictable. Supporters said an income tax cut would help Idaho attract and retain businesses. Opponents said Moyle’s bill would make it more difficult for Idaho to pay for necessary services.

Idaho’s corporate income tax rate and top-end personal income tax rate comes in at 7.4 percent. Only one neighboring state levies a higher rate: Oregon’s rate tops out at 9.9 percent, but the state has no sales tax. “We are not in a competitive position,” said John Watts of the Idaho Chamber Alliance, an umbrella lobbying group that represents 19 chambers of commerce across Idaho.

While Idaho has reduced its state taxes by about $1 billion over the past decade, school districts have collected more than $1.5 billion in voter-approved supplemental property tax levies, said Elinor Chehey of the League of Women Voters.

“These are not tax reductions,” Chehey said of state tax policies. “They’re tax shifts.”

Committee Democrats called HB 67 premature and irresponsible — and said it would undermine funding for schools and infrastructure.

“There’s a right time for everything, and I don’t think this is the right time,” said House Minority Leader Mat Erpelding, D-Boise.

If passed, HB 67 would do several things. It would reduce corporate income tax and top-end individual income tax rates from 7.4 percent to 7.2 percent. It would also exempt the first $750 of individual income from taxes.

Tax bills customarily start in the House. In past years, the House has passed several tax cut proposals that stalled out in the Senate.

And even as they endorsed HB 67, Moyle and other committee Republicans said they hoped to follow up with other tax cuts.

Calling HB 67 “weak sauce,” Rep. Ron Nate put in a pitch for repealing the sales tax on groceries.

“We don’t have a revenue problem in Idaho,” said Nate, R-Rexburg, “We have a spending problem.”

More reading: A look at Idaho’s record reliance on supplemental levies.

School accountability

The Senate Education Committee advanced a bill Tuesday designed to repeal an out-of-date school accountability system.

If passed, Senate Bill 1018 would repeal an unused accountability system that was established in 1990 but fell out of use with the passage of the federal No Child Left Behind Act in 2002.

State Board of Education spokesman Blake Youde said the new bill would help alleviate confusion among schools.

“The board believes this statewide accountability report card is outdated and confusing and worthy of repeal,” Youde said.

Repealing the old system would also clear the way for a new statewide system. Last year, state officials developed a proposed new accountability system designed to comply with the federal Every Student Succeeds Act, which replaced No Child Left Behind.

That new proposed system is making its way through the Legislature in the form of an administrative rule.

Superintendent of Public Instruction Sherri Ybarra is required to submit the accountability system proposal to the U.S. Department of Education this spring or summer. If approved, the new system would govern schools beginning in the 2017-18 school year.

SB 1018 heads next to the Senate floor for a vote.

Teacher certification standards

Senate Education approved a pending rule updating teacher certification standards.

The update is part of a routine process to update 20 percent of the standards for initial certification.

All told, the new standards for endorsements or professional certificates apply to art, biology, chemistry, communications, special education, earth and space science and other disciplines.

“These are the standards by which Idaho universities and colleges are required to meet for certification. If a college or university wants to prepare teachers for certificates or professional endorsements, they have to show their programs will produce candidates that meet these standards.” said Lisa Colon Durham, the State Department of Education’s director of certification and professional standards.

With Senate Education’s approval, the rule is on track to take effect once the legislative session adjourns.

Idaho Education News reporter Clark Corbin contributed to this report.