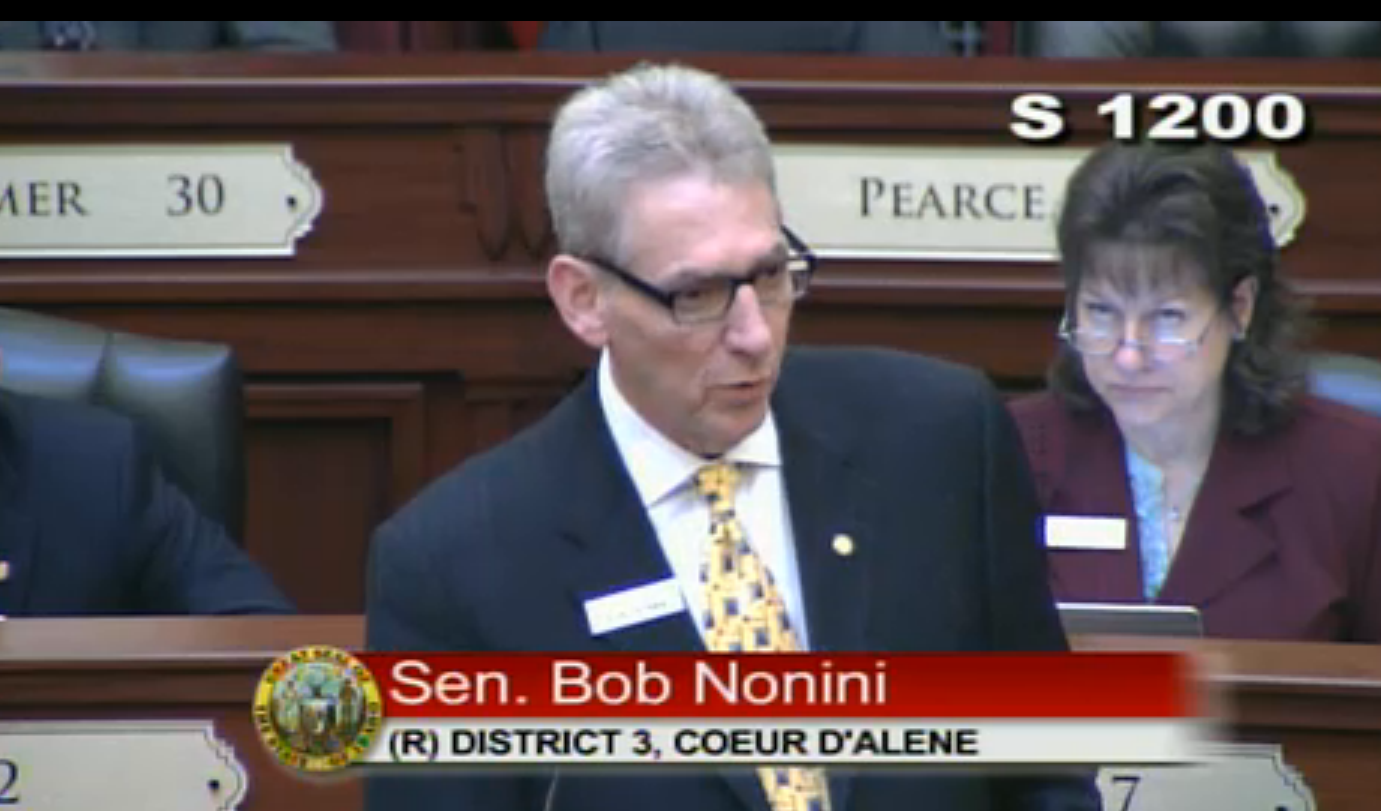

Sen. Bob Nonini isn’t talking much to Idaho news reporters these days; for example, he turned down a request from Idaho Education News a few weeks back, when we wanted to talk to him about his transition from the House to the Senate.

Sen. Bob Nonini isn’t talking much to Idaho news reporters these days; for example, he turned down a request from Idaho Education News a few weeks back, when we wanted to talk to him about his transition from the House to the Senate.

So you have to glean details about the Coeur d’Alene Republican’s legislative agenda any way you can. And from any source.

Which makes this recent article — published by the Heartland Institute, a Chicago organization dedicated to “free-market solutions to social and economic problems” — worthy of a mention here.

Heartland took an interest in Nonini’s bill to grant income tax credits to individuals or companies that contribute to private school scholarship programs. The bill narrowly passed the House but failed in the Senate Local Government and Taxation Committee on a 7-2 vote.

Where does Nonini go from here?

“I plan to continue the push for tax credits for donations to organizations that grant scholarships to qualifying families,” Nonini told Rachel Sheffield, the author of the article and an education research assistant at The Heritage Foundation. “The legislation made substantial progress this year. I will in the interim now be visiting with senators from the tax committee that did not support the legislation to attempt to address their concerns.”